The Under Armoury

Under Armour Design Strategy

(Unofficial Partner)

THE CHALLENGE

Under Armour’s brand is strongly associated with early 2000's male youth sports and overly 'hardcore' high-performance athletes (such as The Rock). Many “casually active” customers don’t see themselves reflected in the brand experience, which makes shopping there feel either outdated, or too far away from their identity.

We focused on Designing a new Product Discovery experience for Under Armour by creating a new ecosystem of services and expanding Under Armour's reach to a new target user who wants to feel confident and equipped—but doesn’t want to need a "high perfomance" athletic identity just to buy workout gear.

Context

Academic +Unofficial Partner Design Strategy Project

10-week strategy + business design engagement.

Skills

Research + synthesis, insight framing, concept + ecosystem strategy, business design + roadmap

FINAL DELIVERABLES

Product Discovery ecosystem

1 Business Blueprint

Team

Ramya, Jack, May, Tiffany, Sam

Understanding the Landscape

Desk Research, Field Observations and Social Listening

We began with secondary research on economic, social, and technological trends shaping the athletic wear industry.

We visited their stores, mainly focusing on their partnership in Dicks to compare their displays and brand voice to the competition. Watching where and how people shopped

Dick's Sporting Goods - Under Armour experience

'Buff' build

Mannequins

mannequins had incredibly athletic builds - lacking in diversity

Intense Brand Images

Brand imaging were very male focused and showed only high intensity athletics

Quiet Tech Messaging

UA offers lots of tech and gear, but it’s mostly explained through written signage that shoppers often ignore.

Understanding people's impressions through online presence

Under armour vs Nike online 'shop' google search

Nike:

Modern, Stylized, Trendy

"Under Armour has failed to latch upon streetwear, or sports style that catapulted OnRunning or Hoka or Merrell,” - CNN

Apparel Technology

A strength, underutilized

UA's seasonal sales -

their shorts and shirt purchases raising in the summer - showing the popularity of their legacy sweat wicking products

Aligning to Under Armour's Brand

It is important to align our focus and design with the Brand itself

Vision:

"To Inspire you with performance solutions you never knew you needed and can't imagine living without."

Mission

"Under Armour Makes Athletes Better"

Brand strength: UA has strong performance tech and legacy credibility in technical gear - gaining popularity first from their athletic undershirt tech.

Gap: UA is “strong in tech", so much so they have tried to become a 'tech company' -

The lack of focus in translating that into everyday apparel or integrating it into UA's shopping and product discovery experience - especially for people not training like athletes - has left many people feeling lackluster about their brand

Diving into User Research &

Finding Insights

We conducted 30–45 minute semi-structured interviews with a wide range of people

Our goal was to understand shopping behavior, emotional drivers, and why people do or don’t engage with Under Armour.

Interview data was clustered into modes of behavior, values, and pain points. We looked for emotional and behavioral patterns rather than surface complaints.

“For men, shopping is a mission. They are out to buy a targeted item and flee the store as quickly as possible.”

-Knowledge at Wharton Staff. “’Men Buy, Women Shop’: The Sexes Have Different Priorities When Walking Down the Aisles.” The Wharton School, 28 Nov. 2007

“I usually just wear whatever my family bought me. Most of it’s business-casual or church clothes, not really stuff I’d choose.”

-Jackson, NU Football Player, Grad Student

Insight 1:

Don’t make me shop

Many men prioritize efficiency, or wait until apparel is gifted to them from loved ones because they see shopping as a task to complete, not an experience, limiting opportunities for brand and product discovery.

“I’ve had this UA hoodie for a really long time, like for a couple years. When I think of UA I think about my sweatshirt, which is very comfy. I wear it a lot.”

-Rithesh, 22 year old college student

“...I think of highlighter yellow tops and being in fifth grade, out on the soccer field.”

-Z, 25 year old Masters student

Insight 2:

Well loved, or worn out?

Men often hold onto old athletic wear because comfort and familiarity create a strong emotional bond. They prefer reliable, well-worn fits, and while many now see Under Armour as dated, it still carries nostalgic memories of early athletic pride and personal milestones.

Many people associate UA with their past athletic phase (like high school or college sports), not their current lifestyle.

“Tight fits or bold pieces make me feel a little exposed and self-conscious.”

-Sauburt, 52 year old active Dad

Insight 3:

I’m not the Rock...

Everyday people can't relate to Under Armour’s focus on performance and hardcore athletes, leaving them disconnected from the brand. They want gear that boosts their confidence with unique flair, but doesn't draw attention so they can still blend into the crowd.

Meet Michael, our target audience, as the research backed representation of the everyday man

Lifestyle

Busy weekday routine

Squeezes in football with his sons

Apparel Habits

Keeps old gym clothes for too long because he knows he feels great in them

Doesn’t feel the need to replace gym clothes

Creating our Framework

We used a 2x2 (Performance ↔ Everyday, Low ↔ High Confidence) to show UA already owns high-performance + high-confidence, but our target everyday older man sits lower-confidence. Our goal was to bring him into UA’s strength by lifting up our every day man to feel like an everyday confident athlete in our clothes

The Product Discovery Ecosystem

We translated this into a business and experience strategy called The Under Armoury, centered on:

An AI-powered “Scouting Report” fit profile

Curated recommendations for the user or their partner

Try-on boxes and guided in-store experiences

Partnerships with Dick’s Sporting Goods to deliver tech-forward discovery

This leveraged Under Armour’s strengths: high-performance technology, strong male fanbase, and retail partnerships—while solving a real emotional and behavioral problem: decision fatigue and shopping avoidance.

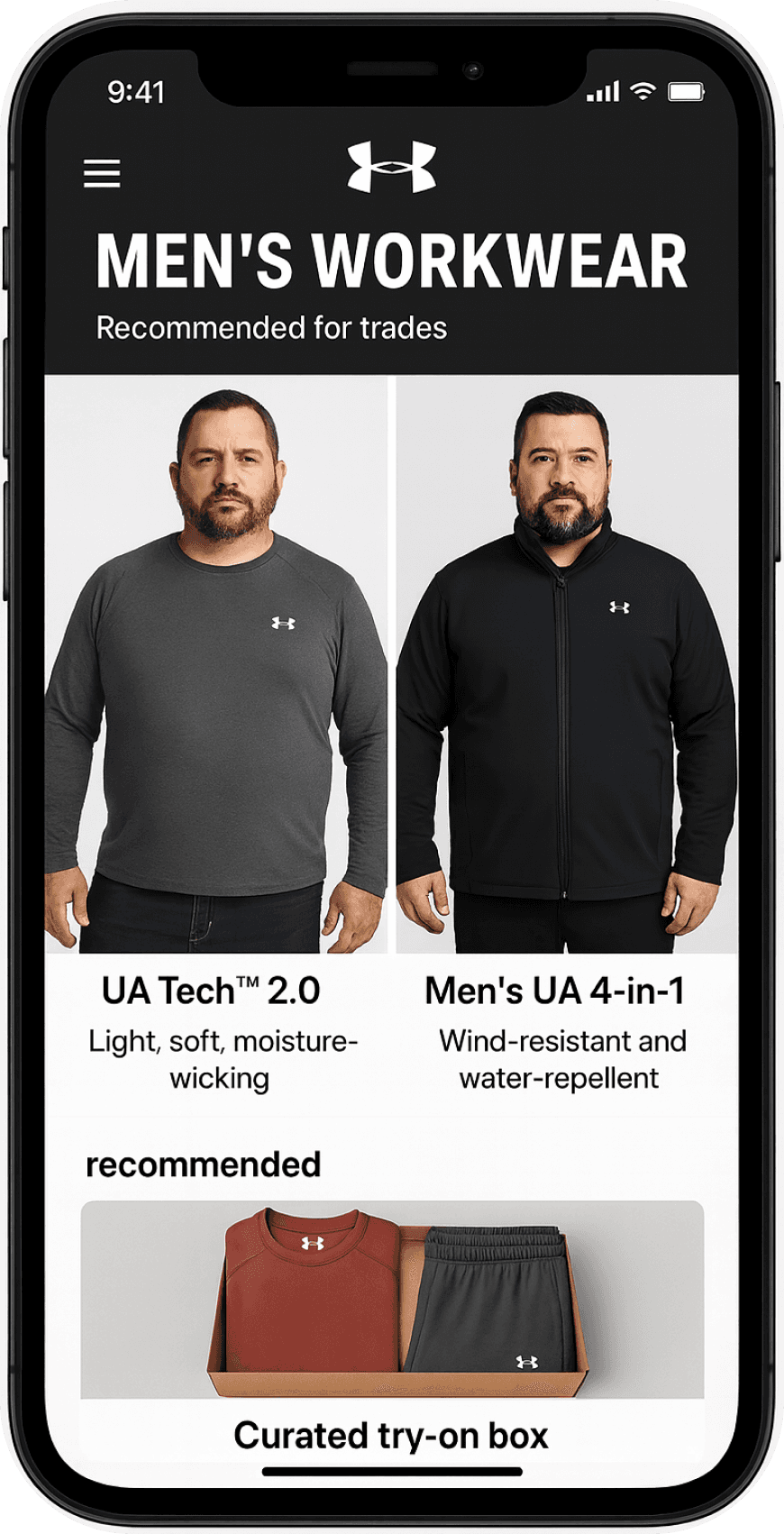

DIGITAL TOUCHPOINT

Online Profile/Scouting Report: Remote AI Curation for personalized curation.

Feature Example: Micheal can take a picture of a worn out shirt he loves - one that maybe his wife wants him to replace - and can get a suggested curated replacement suggestion in his preferred size and color

Trial Boxes: Trial Delivery Boxes that eliminate the stress of figuring out what to wear and having to go out and shop

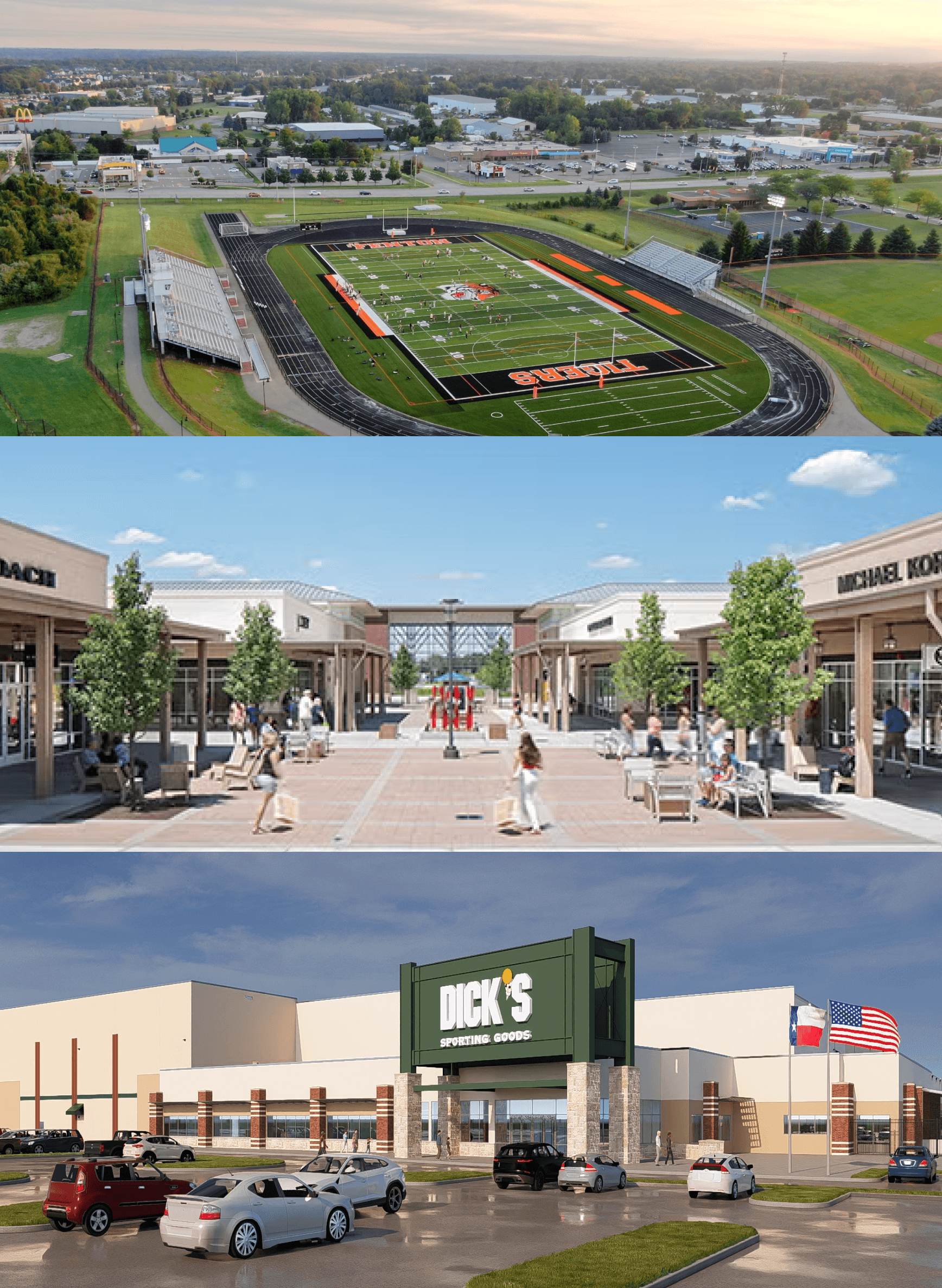

DICKS SPORTING GOODS

Curation touchpoint - try on your online curation pieces in-store

Relatable mannequins with suggested outfits for popular activities ex: beer hockey league and playing football

VIP Heat mapping tech to help find the best pieces for 'sweat spots' during daily and athletic performance

UA AWAY GAME

Trailer Curation Experience

UA employees are dads, with the help of Scouting Report, suggest products that match their physical activity and body

Kiosks/UA employees can sell trial boxes with limited selection in addition to putting in order for trial box with all items

Return boxes with ease

UA AWAY GAME

LOCATIONS

Dick’s Sporting Goods partner store parking lots

Parking and plazas in outdoor malls while men wait for loved ones to shop

High school and college sports games, especially partner schools

Building the Business

Value Prop

For Michael, a casually active man like who quietly doubts he belongs in high-performance gear, The Under Armoury empowers him with effortless shopping and trusted gear so he can feel like his favorite athletes and move through life at his best.

Building the Business

Business Model Canvas – Key Points (Under Armour Project)

Value Proposition: Low-maintenance shopping—personalized, trusted apparel without decision fatigue; works for both the shopper and their partner buying for them.

Customer Segments: Casually active men who dislike shopping; older men who value convenience; partners/family shopping for them.

Channels: Mobile app, try-on boxes, retail partners (Dick’s), and mobile “Under Armoury” trucks.

Customer Relationships: Self-service through app, personal assistance via curators, ongoing support through subscriptions and follow-ups.

Key Activities: AI-driven curation, try-box logistics, immersive in-store and truck experiences, training curators, maintaining tech platform.

Key Resources: Recommendation engine, heat/sweat-mapping tech, trained staff, trucks, immersive retail displays.

Key Partners: Retail partners, shipping carriers, trucking companies, display-tech vendors, celebrity partners.

Revenue Models:

Subscription for recurring curated boxes

Bundled product sales

Premium curated experiences

Group/workplace curation events

Renting trucks for events/tailgates

Cost Structure: Inventory for boxes/stores, staff training, trucks and drivers, tech development, sensors and displays.